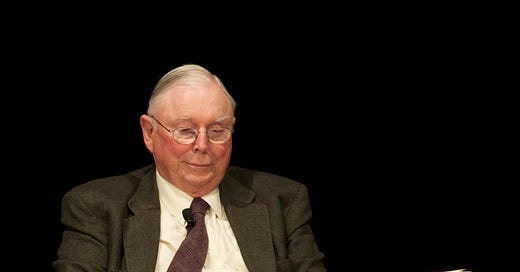

In Memoriam of Charlie Munger

I first learned of the Berkshire Hathaway name in sixth grade when Mr. Hall introduced us to the stock market and investing. Once a week we’d spend a class period peering over a page from the San Jose Mercury News that had the prior days’ stock prices printed. That is how you tracked investments in those days.

“You want to see an expensive stock?” Mr. Hall once asked

“Yeah, sure!”

“Take a look at WFC - Wells Fargo Bank, it's in the $200s”

“Wow!”

“Want to see another one?”

“Yeah, sure!”

“BRK - Berkshire Hathaway - $33,000!”

An audible silence and gasp

“That’s more than my dad’s car cost,” someone said, followed by silence. Even as sixth graders, we could appreciate the enormity of that price.

I filed it away, and mostly ignored that fact, why bother with something I will never be able to own.

“Bill Gates, the founder of Microsoft, is now the wealthiest man alive, having replaced Warren Buffet on the Fortune 100 list!” the news headline announced with excitement.

“Whose Warren Buffett?” I asked my dad, “He works for this company called Berkshire Hathaway, you should see their stock price, it's $45,000 a share, can you believe it?”

Berkshire Hathaway again!

Some more years passed, and my interest in investing grew. I didn’t understand very much about it, mostly haggling with my high school friends who also didn’t know very much, but liked to pretend to have a scoop on the next hot thing. I built too many Yahoo Finance portfolios and spent my lunch breaks checking in on how my mythical investments did.

The more I spent time learning about investing, the more I heard the Warren Buffet name. You couldn’t escape it.

What you didn’t hear as much of was the name of Charlie Munger, but one day, “Today, on CNBC, we’ll be interviewing Charlie Munger from Berkshire Hathaway, coming up after the break!”.

I don’t remember the context, nor the specific interview, but I do remember clearly that Charlie left an impression on me much more than Warren ever did. He was direct, no nonsense, and had no qualms making a tongue in cheek remark, “if people weren’t so often wrong we wouldn’t be so rich.” I had found my mentor!

“I don’t think there are good arguments against my position, the people who oppose my position are idiots.” I had been given permission to speak the way I wanted to speak. If Charlie can say it, so can I!

Charlie’s life story also didn’t fit the normal narrative I’d been fed up to that point in my life. The constant message one sees and reads about is of the end state, the final product, the success, no one wants to talk about what happened before that. Charlie’s early life story isn’t a happy one, it is filled with unbearable tragedy. He lost his son, was divorced, almost bankrupt, and had to rebuild his entire life from scratch well past the time when others are settling into mid-life comfort and convenience. Out of those rubbles emerged a person who had all the reason to be resentful, but he wasn’t. In a 2019 CNBC interview Charlie remarked

“Staying cheerful is a wise thing to do. And can you be cheerful when you’re absolutely mired in deep hatred and resentment? Of course you can’t. So why would you take it on?”

I spent January of 2022 reading “The Essays of Warren Buffett”. It's a typo. It should really be titled “The Essays of Warren Buffett on how Charlie was right.” Warren writes as much about learning from Charlie as he does about his own thinking on investing. What you get out of reading those annual letters is the sense of camaraderie, friendship, and mutual respect that the two had for each other. Although these are indeed the letters of Warren Buffett, in reality, they are also the letters of Charlie Munger.

When I started writing this piece I wanted to lead into something else, I wanted to talk about how Charlie is right about hating Bitcoin, and my own deep analysis of it. I couldn’t find a path to make a segway. Charlie is right, but the why is for another time because talking about Bitcoin is trite in the face of this enormous loss. What we lost is clarity of vision, conviction, and honest integrity in a world so often filled with charlatines.

I wish I had met Charlie in person. I have a gut feeling I would have really liked him and it would have been a life changing event.

May we be inspired to have the moral clarity, intellectual rigor, and deep conviction to stand for what we believe in the face of the strongest of headwinds as our collective tribute to Charlie.